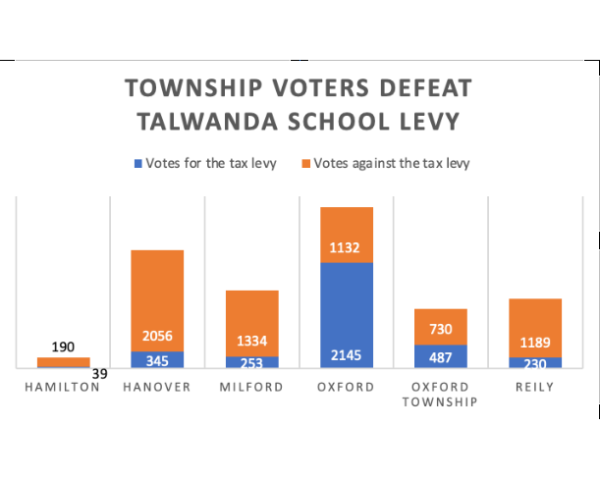

Talawanda budget forecast includes need for levy after 2024

November 19, 2021

This week the Talawanda school board approved a five-year budget forecast that projects the depletion of the district’s financial reserves by 2026 and the need for a tax levy increase before then.

“In fiscal year 2019, we started spending more than what we’re bringing in, causing deficit spending. One or two years of this is OK, but a continuous pattern of this will cause erosion in our cash balance reserves,” District Treasurer Shaunna Tafelski said at the Monday, Nov. 15, meeting.

Tafelski said she recommends having enough money left over at the end of each school year equivalent to the operating costs of 90 days. By 2025, there will only be enough left in the reserves to cover 79 days, and by the end of 2026, this will fall to a mere 35 days, she said.

A levy has not been passed in the district since 2004. In an interview with the Observer, Tafelski said she and other school administrators would like to be able to not put another levy on the ballot until at least 2024, as long as there is the 90-day supply of money in the reserves.

According to the Monday presentation at the board meeting, over the last five years, district expenditures have increased an average of 3.02% per year. Meanwhile, the revenue has only increased by an average of 1.69% per year. Recently, the inflation of material costs for operation has increased at a faster rate than the revenue.

Over the last three years, the district spent an average of over $1.34 million more than it was bringing in. This was possible because the district was able to turn to its reserves.

“Talawanda was very much a locally funded school district and will be more so under the new fair school funding plan,” Tafelski said.

The Fair School Funding Formula has been in development for five years and was passed by the Ohio Legislature as part of the state budget in June 2021. Due to this new funding formula, Talawanda will get 2% less funding from the state, which will need to be made up by local funding.

Currently, Talawanda gets its local revenue from two places. The first is a property tax levy, which does not fluctuate for property owners, even if their property appreciates or depreciates in value.

The second is an income tax levy. Talawanda residents pay 1% of their income toward the district. This does fluctuate with income year-to-year.

In her presentation, Tafelski warned that some seen and unforeseen factors could impact the amount of revenue the school district has. She said there are currently six new housing developments under construction within the district. This means more revenue, but it also means the current buildings may not be large enough to hold the potential influx of new students.

If the five-year forecast is followed, by 2026 the district will be spending over $4.8 million more than it brings in per year.

The final line of Tafelski’s presentation said, “As the forecast stands right now, taking no action, we will need to pass a levy to increase our cash flow – the longer that we wait = higher millage that the community will need to vote/pass. Once again, we need to evaluate and prioritize our spending!”