Oxford Airbnb owners get extra income, but will soon face new taxes

Sam Hinton’s Airbnb rental in the middle of Oxford.

October 1, 2021

When Miami University hosts an event such as “Family Weekend,” Oxford’s relatively few hotels fill up quickly. In turn, local residents become hospitality entrepreneurs and rent out their homes through Airbnb for extra income.

Alison and Joe Kleibscheidel are one of many couples renting out their home this weekend. The couple graduated from Miami back in 2007 and never left Oxford. After having five children, moving to a larger house, and husband Joe enrolling in graduate school, they decided to start hosting on Airbnb five years ago.

“It’s unique right?” Alison said, “If you were anywhere else like Cincinnati, there wouldn’t be such high demand. [But Oxford is] such a small town, and there aren’t a lot of hotels.”

Airbnb is a San Francisco-based online marketing service that lists short-term rental housing, primarily used for holidays and tourism events. Homeowners such as Kleibschedels often live in the properties when they are not being rented. When renters arrive, they move to temporary quarters or stay in an owners’ apartment on the property.

The Airbnb reservation site currently lists 119 homes in or near Oxford. Some properties are in the city itself, while others are as far away as Hamilton. Single rooms can go for as little as $35 per night, while whole houses can range from $100 to $1,500 per night.

The Kleibscheidels only rent their house for about 15 nights out of the year, mainly during major event weekends at Miami like “Family Weekend,” Homecoming and Graduation Weekend. When they have a renter, the family clears out of the house and goes to visit relatives for the weekend, Alison said.

“I’m pretty sure that we are booked for graduation for the next two years,” Alison said.

Both Kleibscheidels have other jobs, but said they have relied on their rental income to pay for preschool tuition for their five children.

“It would be too expensive without it,” Alison said. The Kleibscheidels ask $1,170 per night for their house, she said.

When COVID-19 came into the picture, renting out their home was no longer an option, and the couple went a year without the extra income. Alison said that they had to cut back on spending just like everyone else.

“I was actually just thinking about how it will be two years now that COVID has affected our lives,” Alison said.

Sam Hilton is another Airbnb host with properties in Oxford. When Hilton and his family relocated to nearby Reily, Ohio from Cincinnati, he saw an opportunity in Oxford’s unique rental landscape and decided to invest.

“I saw the rates they were charging, and I saw it would be valuable to move,” Hilton said. “I think there is definitely a shortage here in short-term rentals.”

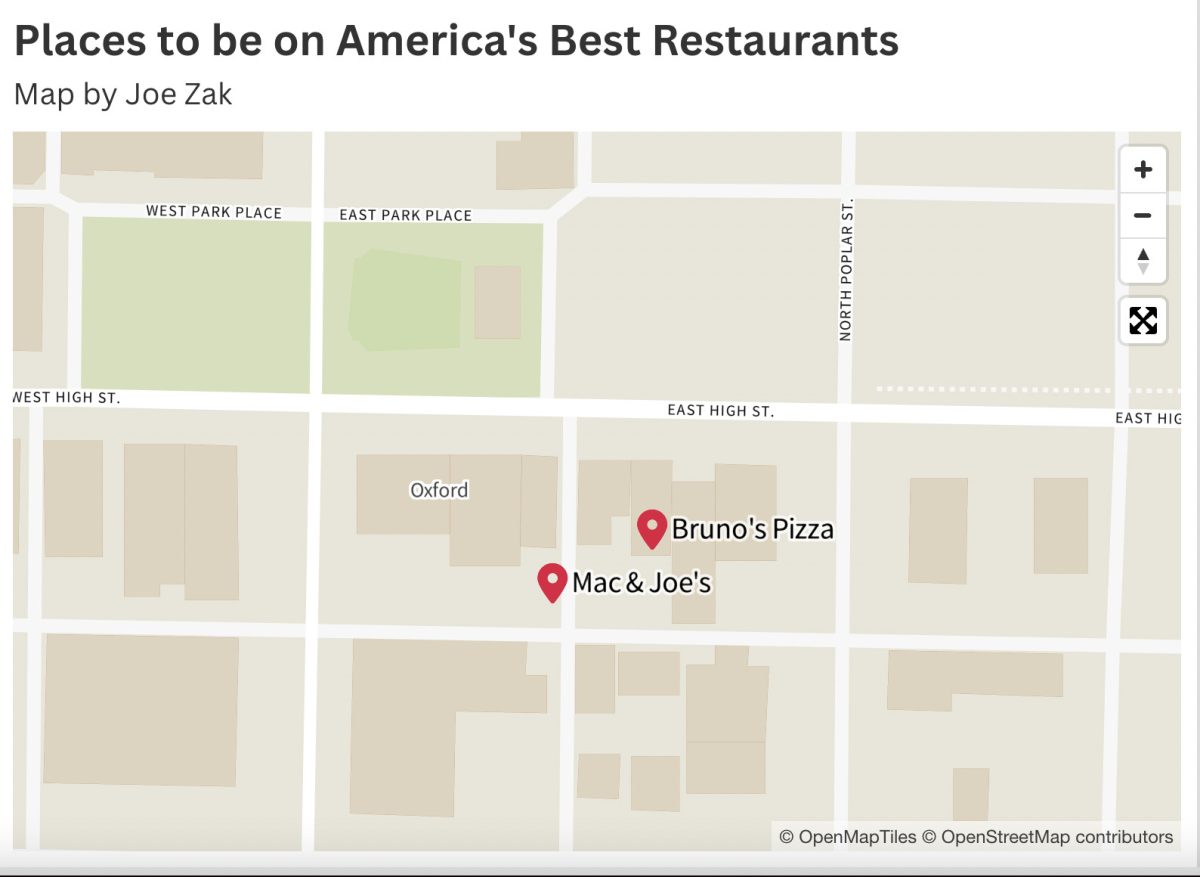

Hilton has two rental properties in Oxford which have both been Airbnb rentals at one time. Now, he has one student rental that he acquired during the pandemic and one Airbnb property in the center of town that he rents out for $186 per night.

“We renovated a home in the middle of town, and we have been Airbnbing it since July,” Hilton said.

Unlike the Kleibscheidels, Hilton rents his home for 90 days a year, the maximum extent possible due to an ordinance passed by City Council regarding transient rentals.

The ordinance was created after the city partnered with Miami’s Farmer School of Business in 2019 to conduct short-term rental research. The results concluded that a majority of these rentals were being rented for three months or less per year.

According to City Planner Zachary Moore, the 90-day figure was generous enough for owner-occupants looking to generate supplemental income for a portion of the year. It also prevents properties in residential neighborhoods from being used commercially with frequent turnover of guests.

“It seemed fair to allow a certain amount of units in town to operate without requiring special approvals,” Moore said.

Hilton said he has his rental property reserved by Miami parents up until the weekend of Thanksgiving, but his prices may be on the rise soon due to a new tax being put in place starting Jan 1, 2022.

In addition to the 90-day restriction, City Council has also passed an ordinance to include Airbnb rental properties in the city’s 6% lodging tax that is currently paid by hotels.

“I don’t think it will change my plans to expand, but I may lean towards more student renting during the school year, and using Airbnb over the summer,” Hilton said.

The lodging tax allocates 3% to Enjoy Oxford, a non-profit tourism organization, and 3% to the city’s Housing Trust Fund. While Hilton will not change his plans to expand, Alison Kleibscheidel said she is frustrated with the tax.

“I don’t think it’s right of the city to take away people’s income who are doing this a couple times a year,” she said. “It’s not a rental property, it’s our home.”

Enjoy Oxford Executive Director Kim Daggy said that because the new tax is so new and will not go into effect until January, the organization has not yet begun brainstorming how they will allocate their funds from the new ordinance.