On Nov. 27, the Butler County Board of Commissioners elected to reduce their collection of property taxes next year by $5.8 million. This means, instead of collecting its fully allocated amount, the county will collect the same as it did in 2023.

This will save the average Butler County homeowner approximately $40, officials said.

Butler County Commissioner T.C. Rogers said the board members approved the partial reduction because they believed the median property tax increase of 37% throughout the county was unfair. The official property tax rates for 2024 have yet to be released.

“Myself and the other commissioners didn’t feel right taking that increase,” Rogers said. “We decided to give all of it [back] rather than piecing out a certain amount of parts … that was the fairest way.”

The money raised from property taxes goes into the county’s general fund, which finances salaries for employees and elected officials, contractual services and materials and supplies. Rogers said the board budgeted based on 2023 property taxes, so the reduction should not have an impact on the county’s plans.

“As commissioners, we do what we can to make our local economy good and stable,” Rogers said. “We can keep our county government costs down.”

Nancy Nix, the Butler County auditor, said county lawmakers have been working on a property tax relief bill all year, but “it’s looking more doubtful.”

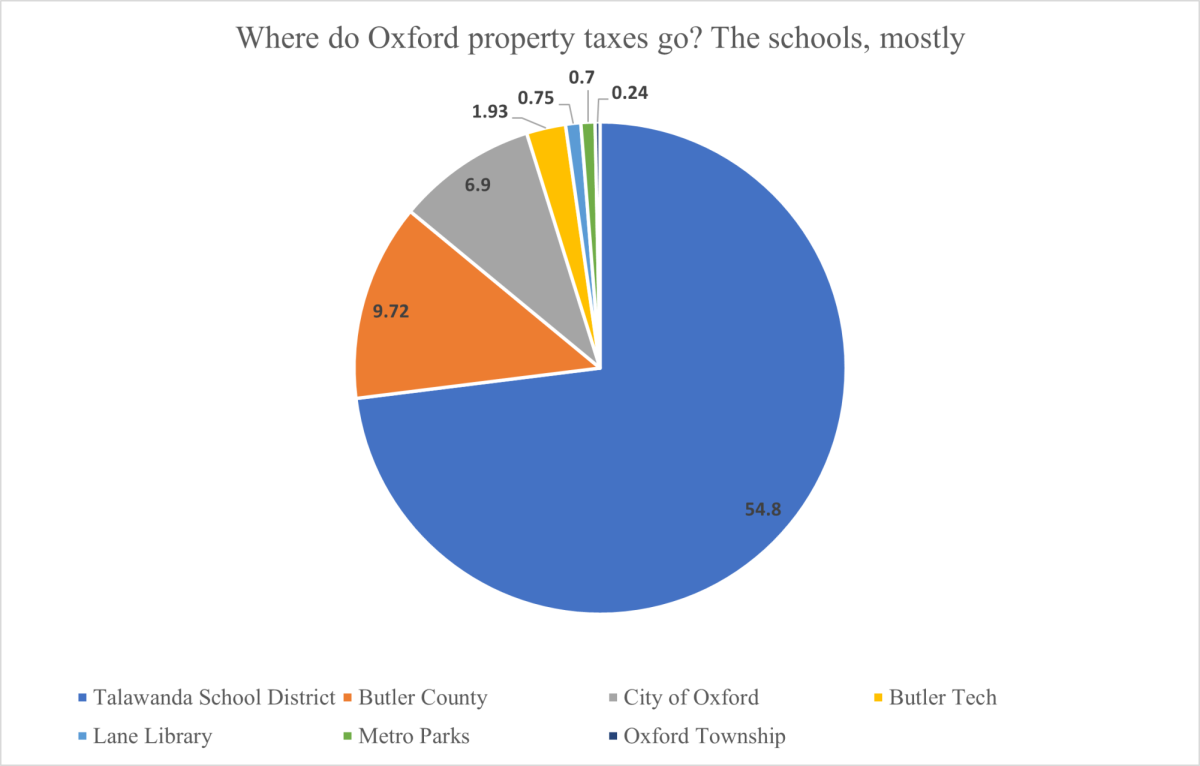

Nix said she asked the school districts, cities and townships to forgo the expected increase, as the county has done, but many of these entities need the additional funding.

“The schools wouldn’t do it,” Nix said. “They said that wouldn’t make sense for them with their state funding formulas. Townships rely so much on property taxes, and they’re dealing with inflation themselves. So, it would be really hard for a regular township to forgo the windfall because they need it for salary raises. Cities just didn’t ever answer.”

Oxford’s City Manager Doug Elliott said the city “did not act upon” the auditor’s request because of the increasing costs of essential services like fire and emergency medical services. The fire department recently received an additional $400,000 from the city’s general fund to hire three more firefighter paramedics.

Elliott said 70% of the city’s general fund comes from income tax as opposed to property taxes, so the increase “amounted to less than $400,000.”

Low-income senior citizens and disabled residents may be able to receive a homestead credit exemption, which reduces property taxes, according to the Ohio Department of Taxation.