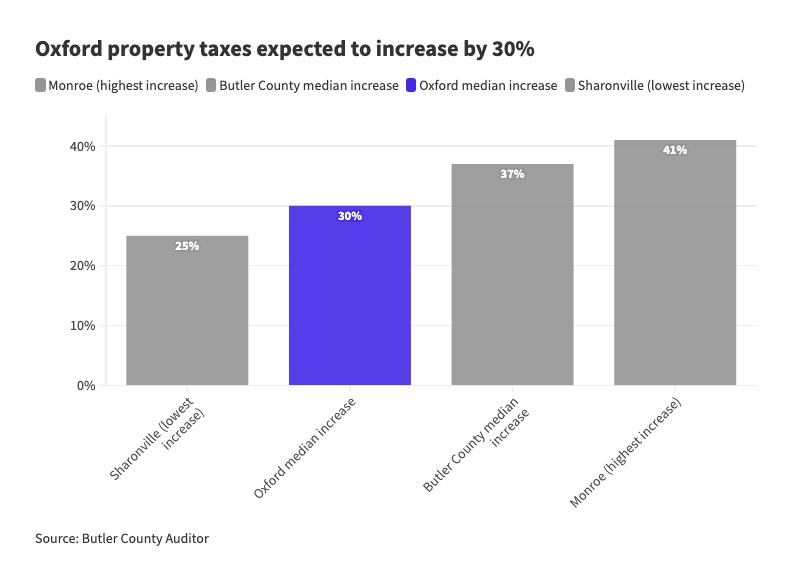

Property owners in Oxford can expect their annual property taxes to go up an average of 30%, according to Butler County Auditor Nancy Nix.

For the owner of a typical house that had been assessed for around $220,000, it means the annual tax bill could go from about $3,500 to about $4,560 in Oxford, according to the auditor.

The amount of the tax increase is still being calculated, Nix said, and state legislation could still lower the bill. Tax bills for the new assessment will be sent at the end of 2023.

The largest share of property taxes goes to local schools. If the increase that Nix predicts goes into effect, Talawanda School District, which receives money from five municipalities, will receive an additional $1 million per year, estimated Shaunna Tafelski, district treasurer.

The school district has imposed cutbacks on school busing and services since the failure of a $5.7 million operating levy.

“It’s not going to take us completely out of trouble though it does help for the next four or so years,” said Patrick Meade, board president. “I don’t envision the board voting to put a levy back on when taxpayers would just be having their taxes raised without a vote, so we’re going to have to figure out how to make this money stretch out to deal with our financial issues.”

Additionally, 20% of property taxes go to the state of Ohio and the balance goes to local municipalities. Doug Elliott, city manager for Oxford, estimates the city will get an additional $348,000 per year.

The million-dollar increase for Talawanda would be placed in the school’s general fund, which helps pay operating expenses, Tafelski said.

“This will be a great hardship for our community members, I just don’t know to what extent at the moment,” Tafelski wrote in an email to the Oxford Observer.

The Butler County auditor’s office says the final numbers for new property values won’t be known until “late in the year.” Once homeowners receive their final numbers, they can file a complaint with the Butler County Board of Revision between Jan. 1 and March 31 if they disagree with their new values. Butler County residents can find their estimated valuations on the auditor’s website.

Charlotte Pendergrass, a realtor with the Oxford RE/MAX, is worried that the higher property values will disrupt the housing market.

“I think anytime you have a substantial increase, that takes money away from other places and then sometimes that knocks people out of the market,” she said.

The property tax increases were triggered by Ohio law requiring county auditors to reassess property values every three years.

The Ohio House of Representatives has introduced a bill, House Bill 187, that would allow county auditors to use the average value of a home over the last three years to calculate its value for tax purposes, instead of looking at the most recent sales.

There are still ways for residents to individually lower their property taxes. They can apply for tax relief options like the homestead exemption, which reduces property taxes for homeowners who are over 65 or disabled and make under $36,100 annually, or the owner occupancy credit, which gives a 2.5% reduction for people who have registered their home as their principal residence.