Oxford Mayor Kate Rousmaniere and an ad hoc business advisory committee are encouraging the city to create a Business Improvement District (BID) to improve the appearance and desirability of uptown.

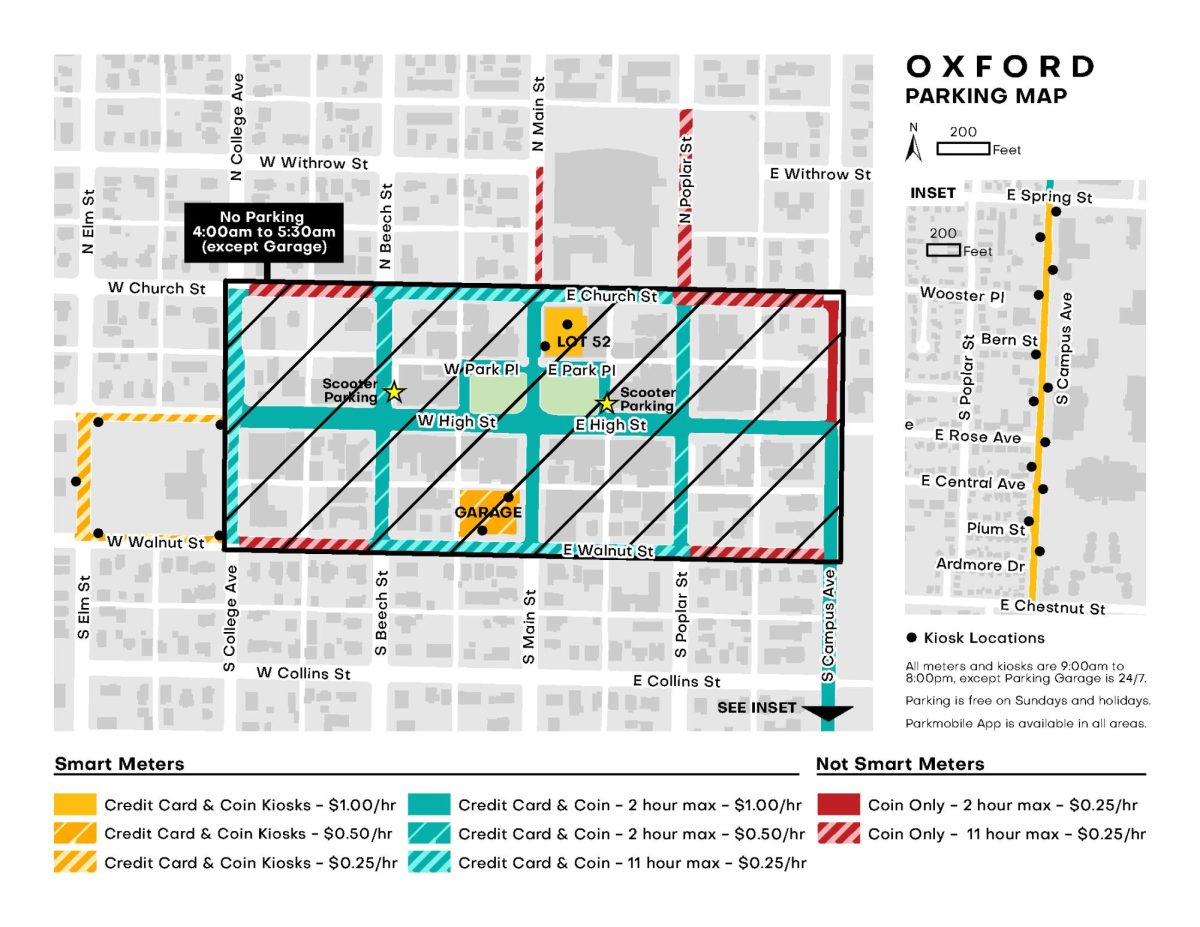

The proposed district, centering around High Street and Martin Luther King Jr. Park, would be bounded by College and Campus avenues to the east and west and by Church and Walnut streets to the north and south. The district would also include all of the connecting side streets.

The plan would be to charge property owners a tax and use that money for such things as streetscaping improvements, clearing snow from the sidewalks and litter pickup, Rousmaniere told the Observer.

“The main concerns uptown are snow shoveling in the winter, gum and cigarettes, litter after Saturday parties, and some vandalism, but I think it’s mostly litter,” Rousmaniere said.

The informal advisory committee discussing the BID is made up of city officials, representatives of the Chamber of Commerce and representatives of Enjoy Oxford, said city economic development director Alan Kyger, a member of the committee. The group aims to create an efficient way for all businesses to chip in on improving Oxford’s streetscape, Kyger said.

Rousmaniere and other committee members said the support of the affected businesses is a key factor in creating the BID.

“Creating a BID is somewhat similar to creating a mall from an operational standpoint. It’s going to be better for us to share in the expense of shoveling snow and picking up litter,” Kyger said.

Kyger said the BID would set aside money to contract for two tiers of projects. The first tier would involve priorities such as shoveling snow off the sidewalks, picking up litter, and power washing the sidewalks to remove gum about twice a year. Without a BID, individual owners are responsible for clearing snow from the sidewalks in front of their properties. The second tier would use money left over to add things like benches or gateway markers to uptown streets.

Multiple models for judging how much a property would be assessed are being considered, Kyger said. Some models use frontage—the length of the building facing the street. It’s unclear how alley businesses or businesses on corners would be handled in that situation. Other models are based on current property taxes.

Rousmaniere said the tax could be in the ballpark of $200 per year. The city’s property in the district, such as parks, would continue to be maintained by the city. Churches would be exempt, but Rousmaniere said they could still opt in on paying it.

“There is absolutely no way the city of Oxford City Council could pass this if the property owners do not want this and do not want to participate,” Kyger said.

By Ohio Revised Code, property owners in affected areas vote via a petition on a possible BID. In order for it to pass, it needs the approval of the owners of 60% of the frontage of properties, or 75% of the land in that area.

City Council would then have to pass an acknowledgment of the creation of the BID, so the BID tax could be factored into property taxes. The money would eventually be funneled back to the BID.

Property owners would also have the option to write a check for the BID either once or twice a year, Kyger said.

The creation of the BID would include a sunset provision that would put the law up for reconsideration in five years.

“If the BID cannot prove that it’s working for the property owners, it would be eliminated,” Kyger said.

The business improvement district would be a nonprofit entity separate from the city, Rousmaniere said. Kyger said board of at least five directors would administer the BID. At least one member would be assigned by the city government, at least one a city council member, and at least three would be property owners within the BID.

“It’s not run by the city, it’s an independent group, like the Chamber of Commerce,” Rousmaniere said.

Jessica Greene, executive director of Enjoy Oxford, said she saw potential benefits in creating a BID.

“I’ll say that I like the idea if only because as a unit of businesses, they might be able to have some more services like snow removal and gum removal,” Greene said. “And this would be one way they could have a self-driving solution, and work together to save costs.”

Cody Costanzo, co-owner of Fridge & Pantry, which is in the proposed district, said the creation of a BID could be a good thing, even though the tax might get passed on to his business through rent.

“I mean that would definitely help because we have to [shovel] all of our own sidewalks and all,” Costanzo said. “It would be nice if we didn’t have to worry about that.”

Having the Chamber of Commerce handles the program was discussed but was ultimately decided against by the committee.

“The Chamber of Commerce is a membership organization, and right now… there’s a lower percentage of businesses in the Uptown district that is Chamber members,” Kyger said. “If this was going to be a Chamber-led and Chamber-financed initiative, you would have a minority number of businesses paying for [the rest].”

Kyger said the next steps in the process involve him completing the database containing each property’s owner, frontage, square footage, and property tax value. He wants to be able to approach property owners with actual estimates of how much a BID would cost each of them.